You’ve worked hard, saved diligently, and reached a point where retirement is finally in sight. You know you’ve done well – but in the quiet moments, a question lingers: “Are we really on track? What if we missed something we can’t fix?”

That uncertainty can cast a shadow over what should be an exciting new chapter. Too often, portfolios just “happen.” A few funds here, a bit of cash there, and suddenly you’ve retired into whatever mix you’ve collected over the years. But retirement is too important to leave to chance.

A portfolio isn’t just a collection of numbers. It’s the engine that powers your lifestyle – the trips you’ll take, the time you’ll spend with grandkids, the peace of mind you’ll feel when markets get rough. The real question isn’t what you own; it’s whether your investments are designed to support the retirement you want to live.

Start with the Foundation: Stocks vs. Bonds

The single most important driver of your long-term investment results is your mix of stocks and bonds – your asset allocation. Everything else (fund selection, tax strategies, even market timing) is secondary.

Think of your portfolio like building a house. You don’t start by picking out the curtains; you start with a solid foundation. In investing, that foundation is the balance between stocks (growth) and bonds (stability).

Your stock-to-bond mix is the biggest driver of how much risk and potential return your portfolio carries. More stocks mean more growth potential – but also more ups and downs. More bonds mean more stability, but less opportunity for long-term growth. Getting this balance right gives you the best chance of meeting your goals without taking on more stress than you need.

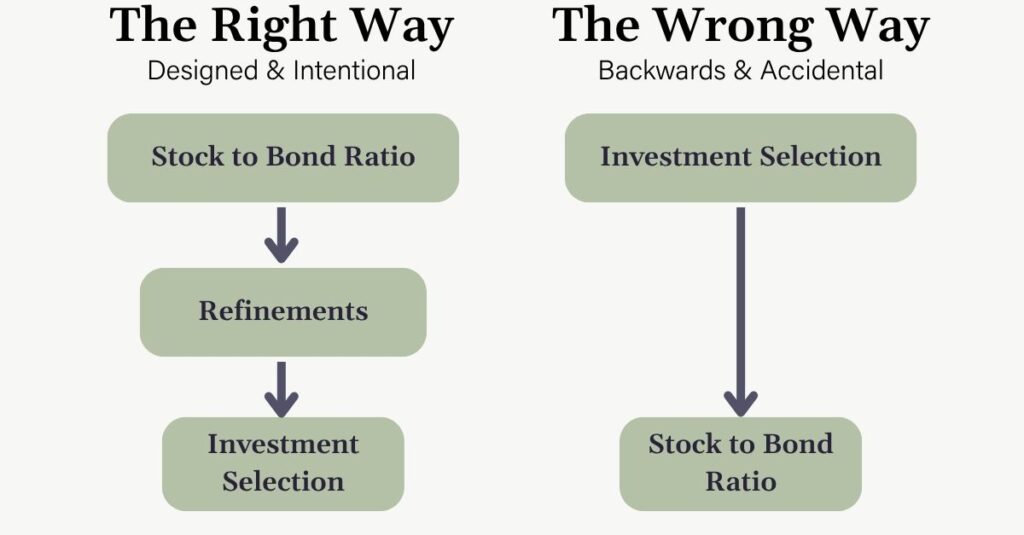

Unfortunately, many investors build their portfolios backwards. They pick funds that sound good – maybe something a friend recommended or something they saw in the news – and end up with an allocation that’s more accidental than intentional.

Here’s a simple way to think about it:

The Right Way (Designed & Intentional)

- Stock/Bond Ratio (foundation – the biggest driver)

- Refinements (domestic vs. international, inflation protection, maybe a tilt toward value or quality if appropriate)

- Investment Selection (the specific funds or ETFs that implement the strategy)

The Wrong Way (Backwards & Accidental)

- Investment Selection (grabbing funds first, hoping they add up)

- Refinements (maybe, but probably not)

- Stock/Bond Ratio (an afterthought rather than the driver)

The takeaway? Don’t drift into a portfolio by chance. Start with the big picture first.

Understanding Risk Tolerance: How You Feel

Risk tolerance is about emotion. It’s how much market volatility you can live with without losing sleep or second-guessing your plan.

Markets often move in cycles, and our emotions tend move with them. When prices rise, it’s easy to feel elated – even greedy. When they fall, fear often takes over. Many investors end up riding this emotional rollercoaster: pulled in when excitement is high, then bailing out when things get scary.

The problem is, that rollercoaster doesn’t point you toward your retirement. It just whips you around and makes you feel queasy.

That’s why your risk tolerance matters. The goal isn’t to chase every up and down, but to stay on the straight line that points toward your goals. That line may look boring – steady, intentional, not flashy – but boring is often what gets you to the finish line.

If a 20% drop in the market (which is likely to happen at some point in your retirement) would make you panic, your allocation may be too aggressive for your comfort. On the other hand, if you can stay focused on the bigger picture – reminding yourself that markets move in cycles, and downturns are part of the journey – then you’re much more likely to stick with your plan.

Your portfolio should support your retirement, not become another source of stress.

Understanding Risk Capacity: What Your Plan Can Afford

Risk tolerance is how you feel. Risk capacity is what the math says your plan can actually handle.

For example, your plan might show that even after a market downturn, you would still have more than enough to fund your lifestyle. In that case, your capacity to take on risk is high, even if your tolerance feels low.

On the other hand, if a downturn would force you to cut essentials or spend down savings too quickly, your capacity is low – even if you feel comfortable taking risk.

The right allocation balances both: what you can stomach emotionally and what your plan can actually support.

Tying It Back to Your Goals

It’s easy to get lost in the weeds of funds, returns, and headlines. But your investments are just tools. They aren’t the goal.

The real question is: Does your portfolio give you the freedom and peace of mind to live the retirement you want? Whether that’s traveling together, spending more time with family, or knowing each spouse will be secure no matter what happens, your investments should be designed to support your vision.

That’s the heart of Purpose-First Planning – starting with the life you want, then building the financial plan to fund it.

Want help clarifying your vision? Download our free Life Beyond the Numbers workbook. It’s designed to help you and your spouse step back from the numbers and design the retirement you truly want.

Stress-Testing Your Plan

A portfolio that looks fine in good times may fall apart when life throws curveballs. Stress-testing helps you see if you’re still okay when the unexpected happens.

You don’t need complex software to start. Here are four ways you can stress-test on your own:

- Market Drop Scenario

- Imagine your portfolio falls by 20–30%.

- Would you still feel comfortable withdrawing what you need each year?

- Longevity Scenario

- Add 5–10 years to your life expectancy.

- Would your savings last if you both lived into your 90s – or beyond?

- Healthcare Shock

- Estimate an unexpected $50,000–$100,000 medical expense.

- Do you have reserves or insurance to cover it without derailing your lifestyle?

- Spending Flexibility

- Could you reduce discretionary spending (like travel) for a year or two if markets had a rough stretch?

- A little flexibility can be one of the strongest protections in retirement.

Doing these quick exercises gives you a sense of where the weak spots may be. The point isn’t to predict the future – it’s to make sure you’re prepared, no matter what happens.

At Parkwoods, we take this further by running multiple scenarios side-by-side, showing you exactly how different choices (like adjusting your stock/bond mix or building a bigger cash reserve) affect your long-term plan. Sometimes just seeing the tradeoffs laid out is what finally helps couples breathe easier. You can get this process started by scheduling a Clarity Call.

Three Common Portfolio Examples

- The Overly Conservative Couple

Everything in cash and CDs feels safe – but inflation quietly eats away at their lifestyle. Over time, they risk not having enough growth to support retirement. - The Overly Aggressive Couple

Heavily invested in stocks, they hope for maximum returns. But a market crash right before retirement could permanently change their plans. - The Aligned Couple

A balanced mix tied directly to their spending plan. Enough growth to stay ahead of inflation, enough stability to feel confident spending on the life they want.

Action Steps to Align Your Portfolio

- Write down your comfort level with losses (in both percentages and dollar amounts).

- Map out how much risk your plan can afford.

- Review your current stock/bond mix: does it line up with both tolerance and capacity?

- Revisit annually, or after major life changes.

Build the Retirement You Want

Retirement isn’t something you should drift into. The right portfolio doesn’t just happen – it’s intentionally designed to support your life.

Don’t just back into retirement. Build the one you truly want and deserve.

Start today by downloading our Life Beyond the Numbers workbook – and begin connecting your portfolio to your purpose.